SBI India ki

sabse popular bank hai. Jo sabse acchi services

apne customer ko provide karati hai. SBI Internet banking ki help se to hum koi bhi kam ghar baite kar sakate

hai. Fund transfer, online payment, bank

statement check karana etc. Aaj is post me hum janenge ki NEFT fund transfer karane ke liye beneficiary

kaise add kiya jata hai.

Beneficiary Kya Hota Hai?

Jab hume kisi

bhi bank me kisi ko online paise transfer karane hote hai tab hum jise paise

transfer karana chahate hai usko beneficiary kaha jata hai.

Internet

banking ke jariye agar hume kisi ko paise transfer karane hai to sabse pahale

hume usko beneficiary add karake approve karana padata hai. Aap directly paise

nahi transfer kar sakate.

Hum yaha be SBI

Net Banking ke me beneficiary kaise add karate hai ye janenge. Add karane ke

bad aap NEFT ki help se paise

transfer kar sakate hai.

Beneficiary Kaise Add Kare:

Step 1:

SBI ki website

pe jake apne user id aur password ki help se log in karle.

Step 2:

Log in karane

ke bad me aapke samane ek option hoga Profile

us pe click kare. Uske bad Manage Beneficiary

pe click karde.

|

| Profile Me Jake Manage Beneficiary Pe click Kare |

Step 3:

Ab aapko Profile Password Pucha jayega. Aapke

account ka jo profile password hota hai wo aapko dalana hai.

Step 4:

Ab aapke samane

beneficiary ki list hogi.

1. Intra- Bank Beneficiary:

Yaha pe aap SBI to SBI kisi bhi bank, branch me paise transfer kar sakate hai.

2. Inter – Bank Beneficiary:

Isme aap SBI to Other Kisi bhi bank me fund transfer kar sakate hai.

Aapko jis bank me fund transfer karana ha uske hisab se upar ke option me se ek option select kare.

|

| Intra-Bank Beneficiary Pe Click Karde |

Step 5:

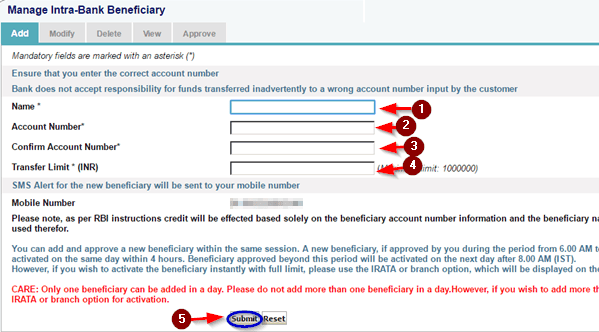

Ab aapko

beneficiary ki details deni padegi (Maine Intra-bank select kiya hai)

Name: Jise

paise transfer karane hai uska naam

Account Number:

Confirm Acc.

Number:

Transfer Limit:

Yane aap jayada se jayada kitne paise transfer karana chahate hai.

Niche submit pe click kare.

|

| Sabhi Details Fill karde |

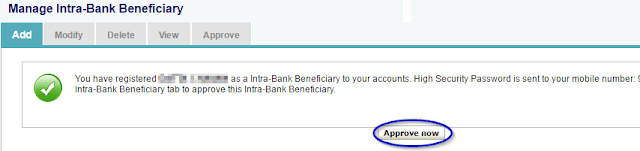

Step 6:

Ab next me

aapko approve now pe click karana

hai.

|

| Approve Now Pe click karde |

Step 7:

Agae aapko

approval type me Approve beneficiary

pe click karana hai.

|

| Approve Beneficiary Pe Click Karde. |

Step 8:

Next step me

aapko approve through OTP

pe click karana hai, aapke register mobile number pe ek high security code

(OTP) send kiya jayega.

|

| OTP Ke Through Approve Kare |

Step 9:

Jo aapke mobile

pe code aaya hai use dalkar approve pe click karde.

|

| OTP Dale |

Step 10:

Ab aapko ek

message dikhayi dega. “You have

successfully added beneficiary” ka.

|

| Message Dikhayi Dega. |

Beneficiary add

kar diya hai us approve hone me 4 hours lagate hai.

Beneficiary Add Karane Se Related kuch FAQ’s:

1. Beneficiary Add

hone me kitna time lagega?

-> Minimum 4 hours lagate hai agar aap din me add karate ho tab. Agar

aap me raat me add kiya to jab bank start hoga uske bad 4 hours me approve ho

jayega.

2. Maximum

Transfer limit kitni hai?

-> Maximum transfer limit 10 Lakhs hai.

3. 1 Din me 1

se jayada beneficiary add kar sakate hai kya?

-> Nahi kar sakate hai. 1 din me 1 hi add kar sakate hai.

4. Online fund

transfer ke liye beneficiary add karana jaruri hai?

-> Yes, it’s compulsory.

Iske alawa

aapke man me agar koi sawal hai to aap humse puch sakate hai. SBI net banking

se related aapka koi bhi sawal ho aap yaha pe puch sakate hai mai aapki puri

help karane ki koshih karunga.

Aapko ye post

kaisi lagi comment me jarur bataye.

Sir sbi net banking se limit money ko kaise btaye. Jiske karan mera balance transfer nhi ho rha hai.

ReplyDelete@ Manohar,

DeleteAapka question mere samaj me nahi aaya aap details me bataye ki aapko kya karana hai.